My Return to India (R2I) story > R2I Chapter 9.1

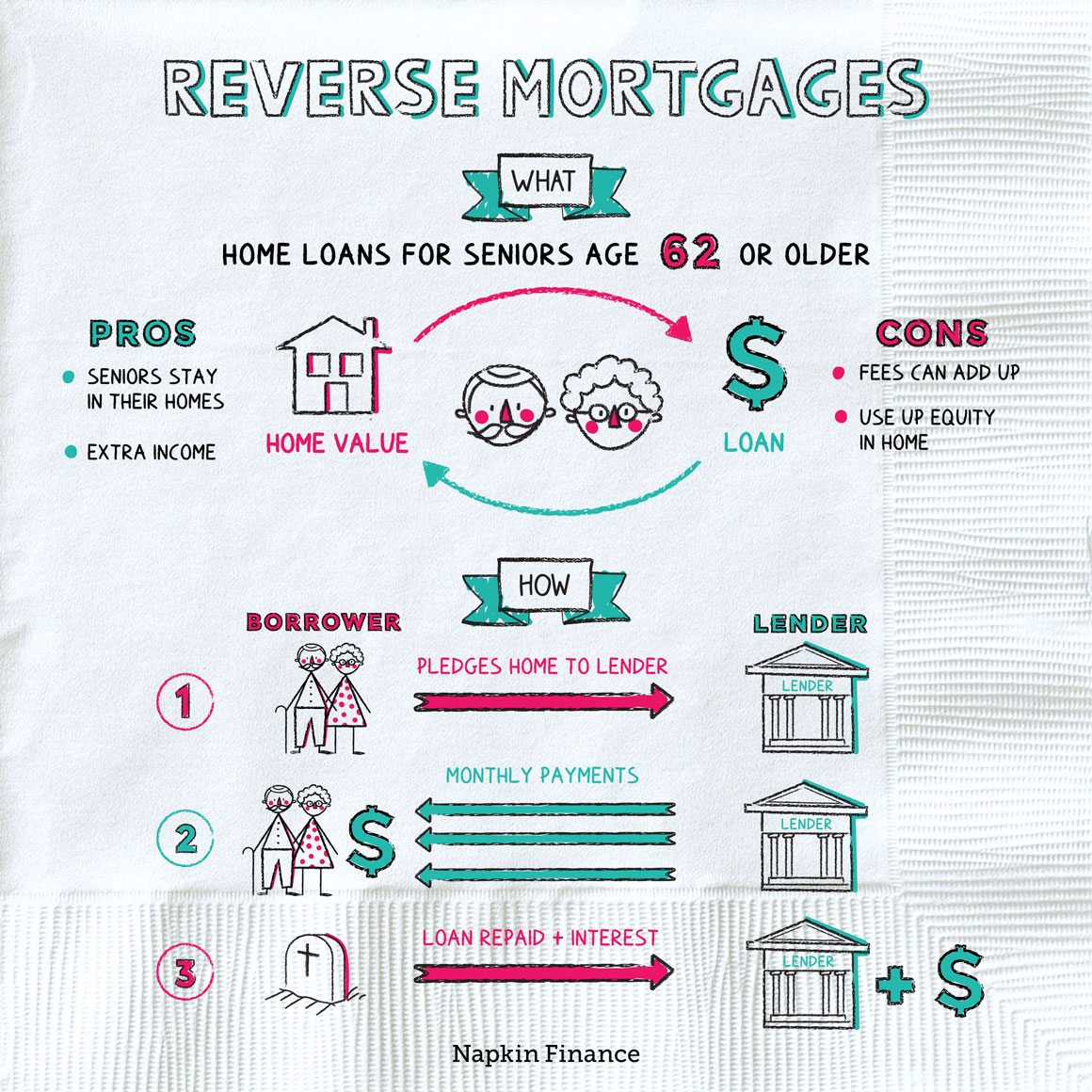

I was vaguely aware of the concept of Reverse Mortgage and had seen advertisements about it in magazines targeting seniors, showing how they can ‘cash in on their nest egg’ to pay for sundry expenses in their golden years.

I decided to read up on the topic and its financial

implications. As the name suggests, the concept is pretty straightforward – it

is the ‘Reverse’ of a mortgage. Many of us take a multi-year loan, a.k.a a

mortgage to buy a home and pay it up in monthly instalments. The monthly

payments consist of interest and payback of the equity. After a set number of

monthly payments over 10-15-30 years, the bank loan is paid off.

A Reverse Mortgage is targeted at people who have paid off

their home loans and have clear title to the property. The bank offers a lump

sum or monthly payment to the seniors for the span of their remaining life.

After the senior dies, the bank may ‘offer’ the title back to the legal heirs

who may have to pay back the lump-sum or aggregated monthly payouts along with

compound interest. If the legal heirs are unable to pay up or don’t want to

take possession of the property, the title may revert to the bank that may sell

it at market value.

The week after, I accompanied my dad to the branch of State

Bank to meet with the manager and I requested him to explain the Reverse

Mortgage. The manager was rather affable and explained the basics and the

terms. For the purposes of the loan, the property had been assessed at about

1.4 crore rupees (about $200,000). A ‘crore’ is a South Asian term for about 10

million, and a ‘lakh’ is hundred thousand. My dad had apparently requested a

lumpsum payout and had received about 50 lakhs after fees and expenses.

The manager went on to explain that given my parent’s age

and expected longevity, with the prevailing rate of interest at about 14.5% a

Reverse Mortgage was considered riskier than other loans and they charged about

3-5% as processing fee. With these complex calculations in the background, they

had arrived at the lumpsum of 50 lakhs.

I asked the manager why he had approved a lump-sum and not

recommended a monthly payout. He explained.

“You are right Mohan, it although it is unusual for seniors

to receive a lump-sum, some folks opted to take the amount to invest in other

ventures.” With a knowing look, he added “you know the real estate sector is

booming in India. It looks like your dad wanted to make some large investments.

Who are we to stop him?”

What about fiscal prudence and impartial advice, I wondered.

Over the next several days, I continued to wonder about the large sum of money that my dad had withdrawn, and he explained that Ramakrishna had recommended a ‘lucrative’ investment in a land that he was managing.

Untying the Gordian Knot

Armed with the basic information about this Reverse

Mortgage, I decided I had to try to understand the long term implications of

this if Suja and I were to continue living in the house with my parents. Suja

and I had taken a leap of faith in relocating back to India and I had assumed

that the home was one variable I didn’t have to worry about. While my parents

didn’t know, during our earlier visit to Bangalore, the doctors had told Manoj

and me that dad had about two years to live and I didn’t want the uncertainty

of the house weighing over my decision. I needed to understand the details of

the ‘investment’ that my dad had made. Along the way, I also had to seek

Manoj’s inputs; after all he was the other legal heir to the property too.

I decided to seek an impartial opinion and reached out to

Chandra, an old friend of mine who now was a partner in a Chartered Accounting

practice. With the compounding of the interest and fees, the loan due was about

70 lakhs. I briefly explained to Chandra about my dad’s decision and the inputs

I received from the bank and told him that the property was now worth over 2 crores.

Chandra simply asked me “While the fiscal angle is clear, do

you want to take on the emotional burden? If you decide to make the investment,

you also need to think about your long-term plans. Do you want to be bound to

this property if you eventually decide to move back to the States?”

He explained that by repaying the loan, the title to the

property would simply revert back to my dad who was free to do what he wanted

with it. After my dad’s passing, my mom and brother would have an equal claim

to the share along with me. Assuming I repaid the bank, they were under no

(legal) obligation to repay me back for my chivalry. From a purely fiscal

standpoint, it was not prudent to move forward unless I had a clear ‘legally

binding’ agreement with my parents and brother.

During the weekly call with Manoj, I updated him of my

conversation with the bank manager and inputs I received from Chandra. I also

asked if he would be willing to join hands with me in repaying the bank and recovering

the title.

Manoj said that he understood the situation but was unable

to make financial commitments at this time and added “It is after all Dad’s

decision and the house was his to begin with. Who are we to question the

decision or to reverse it?”

Ah, what an obedient son, I thought to myself.

I asked him if he would be okay if I decided to repay the

loan and take over ownership of the title and he said he would “think about

it.” He explained that his financial commitments in UK didn’t allow him to

stretch himself in India, and he was finding it hard to visualize the situation

sitting 4,000 miles away.

I decided to proceed alone and got the house reappraised.

The property was now worth about 2 crore rupees (about $275,000). I met Chandra

again and he suggested that we hire a lawyer well versed in property matters.

I gathered the basic facts of the matter before meeting the

lawyer. The four of us – mom, dad, Manoj and I would be entitled to 25% of the

value of the property. Dad and mom had cashed about 55 lakhs in mortgage, fees

and interest that I would repay. In addition, I would pay Manoj 25% of his

value of the property.

The lawyer recommended that we draft two documents after I

repaid the bank – the first, a gift deed from my dad ‘gifting’ the title to me,

that would enable me to register the title.

The second agreement between me and my parents and Manoj for the amount

owed to them.

I had to act quickly and decisively and began arranging the

funds. I transferred some from my accounts in the US and India, taking a hit on

exchange rates and fees. With the funds, dad and I went back to the State Bank

and requested the manager to close the Reverse Mortgage account. He was a bit

perplexed by the move though he came around quickly and arranged for us to

collect the property documents, and the registration and other things followed.

No comments:

Post a Comment