Amid the euphoria over Olympics, news of the worst series of power blackouts in global history occurred in India, impacting millions of people, bringing renewed attention to the crumbling Indian infrastructure. There is bound to be a lot of soul searching among the digerati and political class on the recent power grid failures in India. As is to be expected, there are several angles the Fourth Estate in India and media around the world are going to be examining. Not just the media and career analysts, everyone and their cousin is bound to have their opinions on crumbling infrastructure, inept governments etc etc; Non-Resident Indians like self included.

Reading accounts of the blackout in the media and hearing debate about it on NPR, I am left to wonder if the international media is making a bigger deal of it than it really is? Growing up in different parts of India even in the seventies and eighties, we were accustomed to scheduled and unscheduled blackouts (aka load shedding), especially in summer months when the grids would get overloaded by demand! And this was in an era much before the heralded-India Shining-economic-boom with an insatiable demand for power and energy.

While all this brouhaha will probably lead to a vague call to action, there will be very little soul-searching on the role of businesses in Indian government and society. In case one is wondering why this is important, one must realize how governments around the world, including India, “make” money: they do it primarily through taxes. And herein lies the catch: businesses in India are loath to pay their “fair share” of taxes.

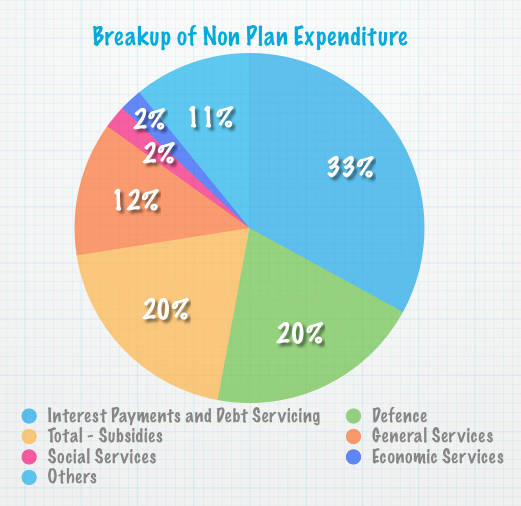

Ref: onemint.com

Business, Government and Society

Bribery, graft, tax evasion and black money is so ingrained in Indian economy that business and corporate leaders are rarely in a position to stick their neck out to “demand” infrastructure from the government, as they should rightly be doing

· They are too bogged down by the system and are trying hard to circumvent their way around the bureaucracy to have the energy to demand what is rightfully theirs

· Bribing their way to get their share of services from the governments at all levels is perceived to be a “competitive advantage”

· And because they have circumvented the system to begin with, they are afraid that by standing up and demanding infrastructure, the babus will hit back at their weakness and lack of contribution to the system – tax evasion, bribery, black money. An income-tax or excise tax “raid” can cripple the business for days if not weeks or months

Aam Aadmi, Government and Society

The average aam aadmi - average Joe- in India, just like business is trying to get by, survive and thrive in a bureaucratic system. For most of those in the non-service sector, tax payment is an “evil” that must be avoided, evaded or circumvented. And the little benefits s/he needs from the government, he gets by bribing his way around. A pay-as-you-go model if you will. This means, the aam aadmi is neither vested in the system nor has the tools to hold the government and society accountable.

The complex multi-cultural layers of governance with little accountability make for an interesting implementation of “democracy” in the world’s largest democracy

If businesses and aam admi are not in a position to demand change, can media, armchair analysts, bloggers and digerati do it alone?

No comments:

Post a Comment